When iTax was introduced a few years back, I was very clueless about it and after lots of frustrations trying to understand how to do it, I ended up filing manual income tax returns.

Still reeling from the frustrations of the previous year, last year I paid someone to do it for me, but this year, I was determined to do it myself and to do it way earlier than June, so I got a friend to walk me through in April (thanks, Peter!) and discovered that it was a very simple process.

They say that the best way to get a lesson to stick, is to teach someone what you've been taught, and I have found this to be true these last few days while showing people how to manoeuvre the iTax system, and in the process, I have also learnt a lot.

I'm writing this post to be able to share what I have learnt and also as a point of reference for the coming years (sometimes memory fails me). This is in reference to filing income tax returns for 2015 in 2016, but it applies whichever year you need to use this guide. So without further ado, let me take you through the process of filing your income tax returns on the iTax system, with a bias on employed, unemployed/students and Kenyans who live abroad. Then I'll handle the FAQs in another blog post. Here we go:

Please note that all Kenyans over 18 are supposed to have a KRA PIN and are supposed to file returns every year, whether they have a job or not (yes, even students must file (nil) returns.) If you fail to file returns, or file them late (after the 30th June deadline), you will be fined Sh10, 000 or 25% of the tax due, whichever figure is higher.

THINGS YOU NEED

If you are currently

employed, you need:

- P9 form – get this from the payroll/accounts department of the employer whom you were working for in 2015. If you had more than one employer in 2015, get the P9 forms from all the employers you were working for in 2015. If you are jobless, but you were working last year, get this from your 2015 employer.

- KRA PIN number – find it on your pay slip or ask your payroll accountant to tell you or get it from KRA by sending a scanned copy of your national ID and requesting for your PIN number. You can reach KRA through their iTax centres around the country, through Huduma Centres around the country, on Facebook or via email callcentre@kra.go.ke or telephone (020) 4999 999, 0711099 999.

- iTax website https://itax.kra.go.ke/

If you are unemployed

and were still unemployed in 2015, you need:

- KRA PIN number – find it on your pay slips from your former job or get it from KRA by sending them a scanned copy of your ID and requesting for your PIN number.

- iTax website https://itax.kra.go.ke/

If you were not

living/working in Kenya in 2015, you need:

- KRA PIN number – find it on your pay slips from your former job in Kenya or get it from KRA by sending them a scanned copy of your national (Kenyan) ID and requesting for your PIN number.

- iTax website https://itax.kra.go.ke/

STEP 1

Go to the iTax website https://itax.kra.go.ke/ and log in (Enter your PIN number and click

continue, enter your password, do the calculation and get the correct answer

and enter it in the relevant space [security stamp] then click log in). If you can’t remember your password, click on “forgot

password/unlock account” and check your email for the new password.

STEP 2

Once you log in,

this is the page you will get.

If you were unemployed for

the entire 2015 (January to December) click on “returns” on the red menu bar (circled in yellow) and choose the

fifth option “File NIL return”. Fill

in the dates: from 01/01/2015 to 31/12/2015 and the other relevant info except

“wife PIN” (unless you are also filing returns for your wife), then click

submit. You are done. Wait for next year to file nil returns again if you still

remain unemployed the whole of 2016. If you get a job, even for a few months, you’ll

need to file returns next year.

If you were not living/working in Kenya for

the entire 2015, also file

nil returns, just like the people who were unemployed.

If you were employed in 2015, whether for a few months or the full year,

click on returns on the red menu bar (circled in yellow) and choose the first

option which is “file returns”

If you have already

filed 2015 returns, but you need to change something, click on returns on the

red menu bar (circled in yellow) and choose the third option which is “file amended return”.

STEP 3

KRA has already filled the first two options for

you, so just click on the drop down arrow on the third option “tax obligation” and choose the relevant

choice. For most people that is the first option “Income tax – resident individual”. Click next.

Income tax – rent income option is for

landlords who are paying tax on rent collected.

STEP 4

Download the Excel

spreadsheet by clicking on it, it will open as a ZIP file. Double-click on the Excel spreadsheet inside the ZIP file

to open it. Keep your P9 form at

hand because you will need to fill the information on it on the Excel spreadsheet.

STEP

5

First things first, click on “enable

content” on the yellow line at the top of the Excel sheet, so you can be

able to fill in the form.

At the bottom, you’ll notice that there are six Excel

sheets and the first one is the one you are on right now. It is called “basic info”. Fill in all the relevant

details and scroll down to fill in the rest of the details if you have a landlord and if

you have a tenant and if you are an auditor (most people don’t need/choose not to fill

these landlord/tenant/auditor details).

Please note that for every field you

choose yes, a new sheet will appear at the bottom of the Excel sheet requiring

you to give more details. You can only fill in the parts that are white and not

the charcoal gray parts. Be sure to fill in every field marked with a red asterisk (*). When

you are done with the “basic info”

sheet, move on to the next sheet titled “F_Employment

Income”.

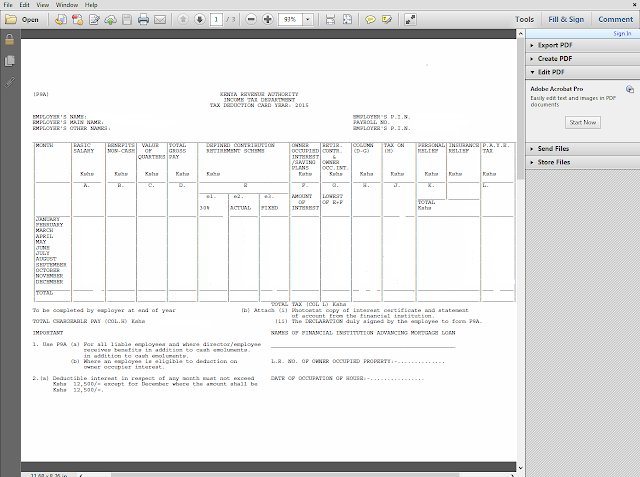

Keep your P9 form at hand because you need it to fill the remaining Excel sheets. This is how a P9 form looks. It is not usually blank, it usually has the figures you need to fill in the KRA Individual Resident Return form on Excel.

STEP

6

Keep your P9 form close. You need it to fill in the gaps on this sheet

titled “F_Employment Income”. Fill

in the PIN and name of your employer from your P9 form. Under “gross pay” write the figure you find

at the bottom of “COLUMN D” in your

P9 form. Most people don’t have allowances and benefits, net value of housing

or pension in excess of 300, 000, so fill in zero (0) in those boxes and move

to the next sheet titled “Details of

PAYE Deducted”

If you had more than one employer in 2015, you'll have more than one P9 form (get them from the respective former employers, payroll department). Include the details from each employer in separate rows (You can add as many rows as the number of employers you had in 2015 and fill in the relevant details using the relevant P9 forms).

Please note that when you are filling the Excel sheets, you cannot "cut and paste" you have to fill in manually.

STEP

7

You still need to use your P9 form, so keep it close.

Open the sheet

titled “Details of PAYE deducted”.

This is the third sheet on the Excel spreadsheet.

- Fill in the name of employer from your P9 form and the employer’s PIN number still from the P9 form.

- Fill in taxable salary from the total figure you get under COLUMN H of your P9 form.

- Fill in Taxable pay on taxable salary from the total figure you get in COLUMN J of the P9 form.

- Fill in amount of tax deducted (PAYE) from the total figure you get on COLUMN L of the P9 form.

Skip the next

two sheets i.e. Skip “Advance tax credits”

and “IT payments credits” and go to

the last sheet titled “Tax computation”.

NB: You only need to fill “Advance

tax credits” if you have a commercial vehicle and you only need to fill “IT payments credits” if you paid tax in

advance, which most people don’t do.

STEP 8

Still use your P9 form.

Open the last sheet

titled “Tax computation”.

You only

need to fill two spaces: “defined/pension

contribution” and “personal relief”.

- For defined/pension contribution, fill in the figure you find under COLUMN e2 on your P9 form.

- For personal relief, for most people it is 13, 944 (which is 1162 multiplied by 12 months), so fill in 13, 944.

- If you worked for less than 12 months in 2015, take the figure you find under “personal relief” COLUMN K on the P9 form and multiply it by the number of months you worked i.e 1162 multiplied by the number of months worked, then fill in the answer you get under “personal relief” on the Excel sheet.

Once you

are done filling in the two fields, scroll down and click “validate”.

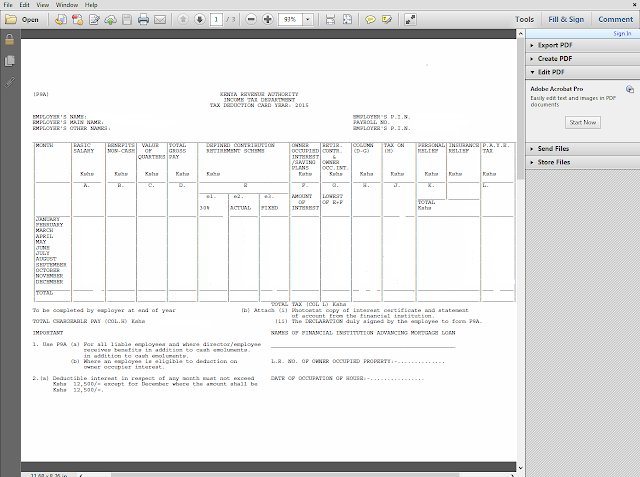

If there are errors,

you will get an alert. At the bottom of the Excel sheet on your extreme left,

click on the red tab with the title “errors”.

It will show you the errors, click on each and give the correct information,

then when you are done fixing all the errors, go back to the last sheet titled

“tax computation” and click “validate” again. You will get a message

asking you if you want to generate a document. Click “yes”. The document (ZIP file) generates automatically and is saved

on your computer under My Documents.

STEP

9

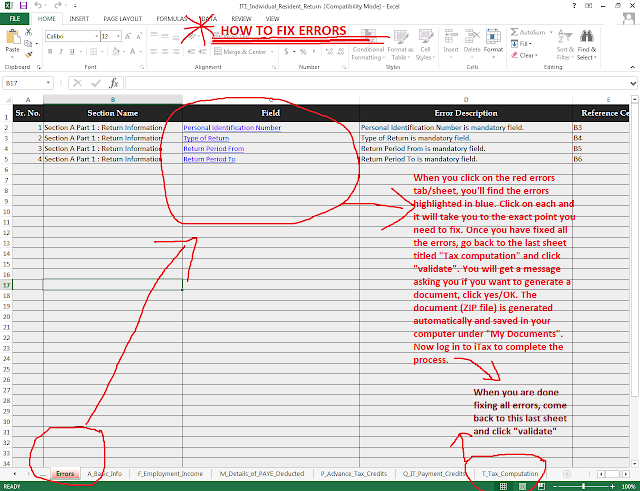

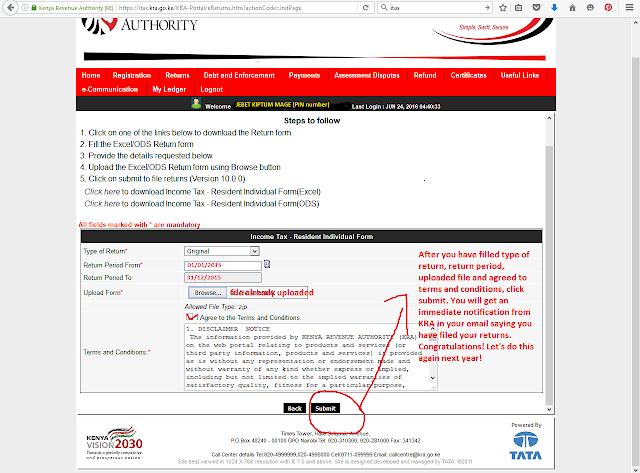

To finish, go back to the iTax website and log in again https://itax.kra.go.ke/,

click “returns” >> file return >> fill the required

info. The required info is: Type

of return, return period 01/01/2015 to 31/12/2015, and then click on browse >> My Documents >> select the ZIP

file you see ending in

_ITR. Click open to upload onto the iTax system. Agree to the terms and conditions, then scroll down

and click “submit”

STEP 10

Check your email for a notification from KRA, it is sent almost

immediately. If the figure in the attached acknowledgment receipt is negative,

KRA owes you (they'll pay you when they feel like, like after five years.

They'll deposit the cash directly into your bank account, which you already

filled in their form). If the figure is positive, you owe KRA. Pay them without

delay.

Congratulations! You are done! Let’s do this again next year.

Remember you can file your returns for 2016 as early as January 2017, you don't have to wait till June (the last minute!)

NB: IF YOU REALISE YOU MADE A MISTAKE AFTER YOU HAVE ALREADY FILED YOUR RETURNS, YOU CAN AMEND/MAKE CHANGES/EDIT >>>:

If after you finish filing your

returns, you realise you made a mistake, worry not, you can change it, but do

so before the 30th June deadline.

To amend your return, repeat the same process, log in to iTax >> click on “returns” >> then “file

amended return”.

Select the tax obligation “Income tax – Resident individual”.

On the next page that opens,

select return period “from

01/01/2015 to 31/01/2015”.

On “type of form to download” select “Excel” then click on download. You will be asked if you want to

download the form for amendment, say OK. The

Excel file you had filled in will download.

Double click on it to open it.

Click on “enable content” on the yellow line you see at the top. Then click

on “amendment” at the bottom left of

the page. You’ll get the Excel sheets with all the information you had already

filled in; all you need to do is to change whatever you are changing, then go

to the last sheet titled “Tax

Computation” and click “validate”.

If there are errors, fix them and click “validate” again. Once you validate, you

will be asked if you want to download a document (just like in STEP 8), say yes/OK and the document will

automatically save in your computer on My

Documents.

Go back to the open amendment

page on iTax and click on browse >>

My Documents >> and select the new ZIP file (check on the

time stamp on the right of the ZIP file to make sure it is the latest i.e. the

amended form). Click “open” to

upload, then click “submit”. You’re

done amending.

And that's it! You're done amending.

Excellent.

ReplyDeleteGreat

ReplyDeletePerfect!!! Puuurrrrfeeecttt!!!

ReplyDeleteOohh..gracious! I'm so greatful..Thank you so much. It's very helpful and well written.

ReplyDeletewhat of the cases where am trying to recover the password but it isnt sent to my email what will i do

ReplyDeleteCheck whether the email is correct and if its not just go to KRA support center with original ID you'll get the correct email changed and password sent to correct email address or send someone with your original ID and letter. If the email is correct but still struggling to get the password, use google chrome to ask for reset.

DeleteGood work done

DeleteHi I have tried filing but I got stuck at a point of spread sheet (zip). Am using my phone to file. How can I download spread sheet?

DeleteIts done just like that...thank you!

ReplyDeleteIn the process of acquiring my certificate from the cyber, the cyber cafe attendant mistakably placed me as a nonresident so i couldn't file the returns last year, what am isupposed to do in order to correct the error and file returns..thanks in advance

ReplyDeleteExcellent. Very elaborate.

ReplyDeleteExcellent. Very elaborate.

ReplyDeleteKRA should pay you millions for simplifying a process that many of us find so complex for nothing, you are a star

ReplyDeleteThis is good

ReplyDeleteThanks for posting the article

ReplyDeleteGST Certification Course in Mumbai

i like your post!!!

ReplyDeleteincome tax return in Chandigarh

Awesome!!!!!!!!!!

ReplyDeleteI was just looking for something like this! Thanks for so much for sharing!.. | File your returns | TAX-IT-HERE

ReplyDeleteImpressed alot.I really like your blog.

ReplyDeleteThanks for the post. Annual return filing

ReplyDeleteThanks for the information... I really love your blog posts... specially those on Income Tax Return efiling

Impressed a lot. I really like your blog

ReplyDeleteThanks for the post.

Income Tax Filing

Oohh..Gracious! I'm so grateful..Thank you so much. It's very helpful and well written. And it’s a better way to pay service taxes. But our company will help you to easily pay service taxes visit our servicesAmerican Tax Returns

ReplyDeleteI am glad to find amazing information from the blog. Thanks for sharing the information. Annual return filing

ReplyDeleteImpressed alot.I really like your blog.

ReplyDeleteThanks for the post. Individual Income returns Filing

I hope you will post more Updates. Thanks for the post. . Tax IT company

ReplyDeleteImpressive! I really like your blog.

ReplyDeleteThanks for the post.

File your returns

I am glad to find amazing information in your blog. Thanks for sharing the information. Tax IT company

ReplyDeleteImpressed a lot. I really like your blog. | Income Tax Payments

ReplyDeleteit have remarkable information about simple guide on income tax returns on iTax in ten easy steps.

ReplyDeleteHire Tax advisors in the UK | Is a trust tax avoidance

Impressed a lot. I really like your blog.

ReplyDeleteThanks for posting your article...It will be very helpful for All. | Income Tax Form 16

I hope you will post more Updates. Thanks for the post... Tax & Financial Planning in Vijayawada

ReplyDeleteThe blog was absolutely fantastic, Lot of information is helpful in some or the other way. Keep updating the blog, looking forward for more content…. Great job, keep it up.

ReplyDeleteIT Returns

It is very helpful information about Digital printing Malaysia. Thanks for sharing

ReplyDeleteTax return

Impressed alot.I really like your blog.

ReplyDeleteThanks for the post

TAX IT Herein Vijayawada

Nice Information!!

ReplyDeleteIt is very helpful information about Digital printing Malaysia. Thanks for sharing

Income tax return filing

Love them all! Thank you for a wonderful share!!!

ReplyDeleteAnnual Return filing in Vijayawada

Nice Information!!

ReplyDeleteIt is very helpful information about Digital printing Malaysia. Thanks for sharing

File Your Returns In Vijayawada

Hello,

ReplyDeleteThis above furnished blog, Providing good information about simple guide on income US Expat Tax Returns.

ReplyDeleteImpressed a loti really like your blog.

Thanks for the post

File your returns

Income Tax Exemptions Section Wise Details and Tax Calculator for AP and Telangana Download. Calculation of Income Tax of Employees and Teachers in Ap and Telangana.

ReplyDeleteThis article is very interesting and helpful. Thank you for sharing!

ReplyDeleteI like your post I will always be coming frequently to read more of your post about the Rebate Specialist Thank you very much for your post once more.

ReplyDeleteCIS Rebate Specialist

Good post but what does a negative total at the bottom mean?

ReplyDeleteThank you. Each and every step of filing an income tax has been clear to me. Tax is an important thing and everyone should have proper information about it. One can gain some knowledge by asking Tax Experts as well.

ReplyDeleteTax tips and tax help to assist taxpayers by describing options for tax reduction and tax cuts through lawful tax deductions. Small business owners need all the tax help which is available. Tucson Tax deductions allow small business owners to keep more of what they earn.

ReplyDeleteThanks for the detailed guide.

ReplyDeleteThe screenshots and step-by-step procedure makes it easy to follow

This comment has been removed by a blog administrator.

ReplyDeleteperfect

ReplyDeleteThanks a lot..this has been so helpful.

ReplyDeleteAn impressive share! I have just forwarded this onto a coworker who had been conducting a little homework on this. And he in fact bought me dinner due to the fact that I found it for him... lol. So allow me to reword this.... Thank YOU for the meal!! But yeah, thanx for spending time to discuss this topic here on your website. Cute Captions

ReplyDeleteHello there! I could have sworn I’ve been to this site before but after going through a few of the posts I realized it’s new to me. Nonetheless, I’m certainly pleased I discovered it and I’ll be book-marking it and checking back frequently! all sports betting

ReplyDeleteWhat you have shared is very inspiring and informative. You’ve definitely got a new fan here! Thank you for sharing. Would love to see more updates from you.

ReplyDeleteTax Advisor

Thabks so much for this post. It is really elaborate.

ReplyDeleteNeeded to compose you a tiny note to finally thank you very much yet again for your personal splendid methods you have discussed above. It is strangely open-handed with people like you to provide publicly all that a number of people would have marketed as an electronic book to generate some bucks for their own end, primarily now that you could possibly have tried it if you ever wanted. These inspiring ideas likewise acted like a fantastic way to know that the rest have the same dreams really like my personal own to see a whole lot more concerning this problem. I’m sure there are thousands of more enjoyable times in the future for many who check out your blog. First Wishes For Friendship Day

ReplyDeleteGreat Info, Your blog is very informative and interesting, your all post are amazing, keep sharing more interesting topics. Thanks.

ReplyDeleteComputer courses after 12th commerce students

help filling in tax return yourbooksontime in Virginia.

ReplyDeleteI wanted to say Appreciate providing these details, youre doing a great job with the site... pandora one apk ios [url=https://androidapkwala.com/pandora-apk/]pandora one apk ios[/url]

ReplyDeleteTAX SERVICES

ReplyDeleteWE provides various services in relation to income tax for both individuals and companies, services include, Tax Planning, Filling of Income Tax Returns, Tax Refund

Tax return

income tax services

WE gives different administrations in connection to salary charge for the two people and organizations, administrations incorporate, Tax Planning, Filling of Income Tax Returns, Tax Refund

ReplyDeleteTax return

income tax services

Enormous blog you individuals have made there, I entirely appreciate the work. Free legal aid

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteI am happy to find your distinguished way of writing the post. Now you make it easy for me to understand and implement the concept. Thank you for the post. Tax Return

ReplyDeleteCan we use digital signature for income tax for password unlock

ReplyDeleteArticle goes over vital steps to ensure that you build a business you can sell, as well as getting the best price possible. Have accurate financial statements, a concise way to demonstrate the potential growth, as well as the management blue sky financial employee structure.

ReplyDeleteStarting convert currency small business or a home-based business is not something that should be entered into lightly. More often than not you'll go through a long period languishing while trying to make your business viable

ReplyDeleteBuilding a business requires considerable time and effort, and how do https://cad.cheapsoftwaredownload.net/catia.html maintain your business legacy? Read on to learn how you can help protect your business in the future through business succession planning

ReplyDeletehttps://felepiphany.blogspot.com/2016/06/how-to-file-your-income-tax-returns-on.html?showComment=1523961641580#c3109117829095571607

ReplyDeletehttps://envirojpo.blogspot.com/2016/11/the-carbon-tax.html?showComment=1523961655001#c6008062059722078828

https://econperspectives.blogspot.com/2008/12/equity-of-tax-system.html?showComment=1523961663018#c6536814466553076528

https://economic-incentives.blogspot.com/2017/10/effective-corporate-tax-rates-in-c.html?showComment=1523961688093#c1755751392269548595

https://animationapprentice.blogspot.com/2014/07/a-freelancer-animators-guide-to-taxes.html?showComment=1523962014597#c514305410461573684

https://detroitrusttoriches.blogspot.com/2013/02/detroits-no-tax-property-tax.html?showComment=1523961721441#c2977256789579321842

http://www.shaneshirley.com/2017/05/how-retailers-can-use-reusable-bags-to.html?showComment=1524132343093#c1967294428721165943

https://cafinalunplugged.blogspot.com/2012/11/due-date-for-payment-of-service-tax-and.html?showComment=1523961747684#c7609710059006646299

https://bedbuffalos.blogspot.com/2009/09/why-irs-refuses-to-spell-my-name.html?showComment=1523961768227#c4850862150913382446

https://alanagkelly.blogspot.com/2011/07/who-pays-most-in-taxes.html?showComment=1523961996295#c3374772323366738470

being a blogger myself . i can see someone with great potential. Spotify apk premium

ReplyDeleteHello there I am so glad I found your blog page, I really found you by mistake, while I was looking on Bing for something else, Anyways I am here now and would just like to say thanks a lot for a marvelous post and a all round entertaining blog (I also love the theme/design), I donít have time to browse it all at the moment but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read more, Please do keep up the awesome job. Happy New Year Wallpapers 2020

ReplyDeleteHello there I am so glad I found your blog page, I really found you by mistake, while I was looking on Bing for something else, Anyways I am here now and would just like to say thanks a lot for a marvelous post and a all round entertaining blog (I also love the theme/design), I donít have time to browse it all at the moment but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read more, Please do keep up the awesome job. Happy New Year Wallpapers 2020

This is a correct blog for anybody who really wants to be made aware of this topic. You understand so much its practically challenging to argue along (not too I actually would want…HaHa). You certainly put the latest spin with a topic thats been discussed for decades. Great stuff, just wonderful! Happy New Year Wallpapers 2020

ReplyDeleteYes i am totally agreed with this article and i just want say that this article is very nice and very informative article.I will make sure to be reading your blog more. You made a good point but I can't help but wonder, what about the other side? !!!!!!THANKS!!!!!! small printer

ReplyDeleteThese are some great tools that i definitely use for SEO work. This is a great list to use in the future..

ReplyDeletemy company

This type of message always inspiring and I prefer to read content, so happy to find good place to many here in the post, the writing is just great, thanks for the post.

ReplyDeletewebsites

Starting an online business regardless of what type it is, can really be a daunting process. With hundreds of businesses cramming the internet on a daily basis and with the millions already there, I have to ask the question, Do I have a chance of success in whatever niche my business falls into? There are times when some of us have come to the end of the road for our 9am to 5pm jobs, and we think it's time to take on the challenge of being our own boss and manage our own business. However, there are a number of things to take into consideration when thinking about starting your own business. I will only focus on ten main things from a long list which, in my opinion, are of paramount importance when considering an online business. coreldraw x8 offline installer

ReplyDeleteParticular paid google internet pages offer complete databases relating whilst personal essentials of persons while range beginning telephone number, civil drive public records, as well as criminal arrest back-ground documents. buy solidworks australia

ReplyDeleteVos traité : bon plusieurs sûrs thèmes de conflit pourtant je discute de la véracité de la plupart des arguments affichés ci dessus dans cet ultime étude; cheap software

ReplyDeleteTaxation has the potential to decrease consumer spending, because taxes take money away from consumers and reduce disposable income.

ReplyDeletetailored tax strategies

Why Factoring might be the perfect solutions for your working capital financing challenges. Information on accounts receivable finance for Canadian business owners and how cash flow financing can solve working capital challenges. bond purchases

ReplyDeleteUsually I don’t read post on blogs, but I would like to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, quite nice article. 먹튀사이트

ReplyDeleteTogether with almost everything that appears to be building throughout this specific subject matter, many of your points of view happen to be fairly radical. However, I am sorry, because I can not give credence to your entire strategy, all be it refreshing none the less. It looks to me that your remarks are generally not completely validated and in reality you are yourself not entirely convinced of your assertion. In any case I did appreciate looking at it. 먹튀

ReplyDeleteIt can be easy to lose sight of the very reasons why you wanted to open your business startup. You can get wrapped up in the day-to-day operations, leaving little time to focus on what makes your business startup standout in the market. Having a strategy in place that allows you to keep you motivated can ensure your business stays on a path of success ONLINE TUTORING

ReplyDeleteChina has been aggressive towards cryptocurrency over the past few years. With increasing adoption of blockchain, cryptocurrency is gaining popularity as an alternative investment. I will explore how China is moving towards a blockchain-enabled nation and accept cryptocurrency in the near future. crypto

ReplyDeleteFinancing a car is a very important process and today with the availability of numerous car finance brokers it has become an easy option to get secure car loans. Today these car finance brokers are playing a vital role in assisting car buyers as well. In this article, know more about various important factors that you should keep in mind while making a selection of a car finance broker. сrypto robot

ReplyDeleteFinancing a car is a very important process and today with the availability of numerous car finance brokers it has become an easy option to get secure car loans. Today these car finance brokers are playing a vital role in assisting car buyers as well. In this article, know more about various important factors that you should keep in mind while making a selection of a car finance broker. bitcoin faucet list

ReplyDeleteเหล็กดัดเชียงใหม่ ( chiangmai Wrought iron ) รับติดตั้ง ประตูเหล็กดัด เหล็กดัดหน้าต่าง เหล็กดัดอิตาลีเชียงใหม่ มุ้งลวดเหล็กดัด มุ้งจีบ งานกระจก อลูมิเนียม กันสาด ทุกรูปแบบ เหล็กดัดหน้าต่างเชียงใหม่

ReplyDeleteAre you having a financial business website? Are you happy with the return of your investment in developing the website? I mean to say is the site focused to showcase your business? If the case is otherwise, you are in need of one of the best finance website templates. There are many excellent finance web templates available in the template shops. The matter of success hides inside your wise decision. Payday Loans

ReplyDeleteNowadays, many business owners are conducting their business online. Because they have seen the number of responses they receive from their online audience, business owners have seen this as a huge help for promoting their company. This is why there are so many of them who hire social media marketers who are knowledgeable in this growing trend. But given the fact that there are now so many companies and individuals who offer social media marketing services, it is important to look for the right provider. As such, the 4 principles of social media marketing need to be observed by the chosen online marketer. best email builders

ReplyDeleteFinancing a car is a very important process and today with the availability of numerous car finance brokers it has become an easy option to get secure car loans. Today these car finance brokers are playing a vital role in assisting car buyers as well. In this article, know more about various important factors that you should keep in mind while making a selection of a car finance broker. $500 loan for bad credit from UnitedFinances.com

ReplyDeleteFinancing a small business can be most time consuming activity for a business owner. It can be the most important part of growing a business, but one must be careful not to allow it to consume the business. Finance is the relationship between cash, risk and value. Manage each well and you will have healthy finance mix for your business. تداول العملات

ReplyDeleteFinancing a small business can be most time consuming activity for a business owner. It can be the most important part of growing a business, but one must be careful not to allow it to consume the business. Finance is the relationship between cash, risk and value. Manage each well and you will have healthy finance mix for your business. تداول العملات

ReplyDeleteFinancing a car is a very important process and today with the availability of numerous car finance brokers it has become an easy option to get secure car loans. Today these car finance brokers are playing a vital role in assisting car buyers as well. In this article, know more about various important factors that you should keep in mind while making a selection of a car finance broker. adult url shortener

ReplyDeleteI have been exploring for a bit for any high quality articles or blog posts in this kind of space . Exploring in Yahoo I ultimately stumbled upon this web site. Studying this information So i am glad to show that I have a very excellent uncanny feeling I discovered just what I needed. I such a lot unquestionably will make sure to do not disregard this website and give it a look regularly. jewelry stores dallas

ReplyDeleteIn our series of finance recruitment articles, we will be looking at various finance job roles. The first in the series is the role of a Finance Controller. 5 paisa

ReplyDeleteThankyou sir your blog is providing such a beautiful knowledge about Tax Return Services in London,

ReplyDeleteTax Return Services in London

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don't know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often. https://194.32.78.99/

ReplyDeleteEffective Social Media Marketing requires strong multi-tasking and solid organization skills. Without these two key requirements, a small business owner can be easily overwhelmed and consumed by a "beast" starved for jealous attention and fruitless labor. youtube smm panel

ReplyDeleteThis is awesome article thank you

ReplyDeleteReduce risk and achieve better control over your tax accounting function through improved and more efficient processes. Taxation Service Singapore have dedicated technical specialists around the globe provide guidance, and best practices, on a range of tax accounting issues. We also support you in Tax provision outsourcing.

Very interesting article, I really appreciate it.

ReplyDeleteJSE Offices provide professional Payroll Services Singapore at the inexpensive price. Allow us to assist you in taking care of your employees so you can focus on meeting your company's productivity and profitability goals. Don't let payroll become a hassle; instead, let us assist you in resolving the problem. For further information, please contact us.

If you prefer to require the advantage of Company Incorporation Singapore, then you need to choose JSE Offices. Here you'll experience professional and quality service altogether legal matters like incorporation, compliance, conversion, tax registration, and legal agreements. Whereas, an organized business likes financial obligation partnership, private and public Ltd. is more sustainable and commercially viable.

ReplyDeleteAfter registration, a company must appoint a company secretary within six months. A corporate secretary is considered an officer of the company. Here are some Corporate Secretary Services, firstly a company secretary must ensure the smooth running of the business by following the Singapore company law and procedure; secondly ensure there should be no breach of set rules and regulations.

ReplyDeletePositive site, where did u come up with the information on this posting?I have read a few of the articles on your website now, and I really like your style. Thanks a million and please keep up the effective work. تأشيرة-الهند-التجارية

ReplyDeleteA company that has annual revenue of more than Rs 20 lakhs is required to register under the Goods and Services Tax. We are providing company GST registration that will benefit a taxpayer in the following ways: He has legal status as a provider of products or services. He is legally permitted to collect tax from his customers and to credit the purchasers/recipients for the taxes paid on the goods or services provided.

ReplyDeleteOne of the most important teaching tools the teacher has in the EFL-classroom is the teaching of a foreign language through games. This article tells you how to teach grammar using games with fun examples for you to try out with your ESL students. Niche: binomo

ReplyDeleteMining rigs for sale with worldwide delivery. We are a team of professionals with experience in Blockchain Management, Offline Sales, and best miner for lyra2rev2 Mining. Innosilicon g32 grin miner and best miner for lyra2rev2. As experts in Asic mining rigs for sale, we are specialists in reselling Antminer hardware since 2017! We exclusively sell products of the manufacturer and brand Bitmain so we can offer you great service and the best online pricing. ibelink, ibelink Asic, ibelink bm-k1, bitmain antminer s13 pro, bitcoin miners.

ReplyDeleteGet ready to expand your startup business to Singapore. We at JSE Offices specialize in providing Bookkeeping Services Singapore to help people succeed regionally and globally. Most of the little and medium businesses always ensure to stay their expenses under a particular limit. Hence, we engage in providing bookkeeping services.

ReplyDeleteIn order for any business to be successful, you must put ethics first and foremost. This means staying with what really works and staying away from what doesn't work. This isn't as easy as it seams as you will see from the article. However, it can be achieved. Latest crypto news

ReplyDeleteCryptocurrencies seem to be the hottest investment products going around. Eavesdrop on any of your friend's conversation, it is about bitcoins. All the workplace chat is also about virtual currencies. abra app

ReplyDeleteCryptocurrencies seem to be the hottest investment products going around. Eavesdrop on any of your friend's conversation, it is about bitcoins. All the workplace chat is also about virtual currencies. referral code

ReplyDeleteCryptocurrencies seem to be the hottest investment products going around. Eavesdrop on any of your friend's conversation, it is about bitcoins. All the workplace chat is also about virtual currencies. bybit referral code

ReplyDeleteA business plan is one of the most important documents that is needed for the betterment of the business.It includes all the need to know strategies, marketing techniques, sales techniques and financial forecasting methods that will be used to increase profits and revenue of the business. However, writing a business plan is no walk in the park. It takes a lot of time and concentration and is one of the biggest responsibilities that will be undertaken. For this crucial task there are dedicated people called business plan consultants. prize bond

ReplyDeleteWhere is your small business at now? Do you have a charted plan? Do you get great advise? This article highlights 10 points that will assist the small business mindset of each and every business owner that reads it. 9janews

ReplyDeleteRespect and I have a super give: How Much Are House Renovations Stardew Valley small house renovation

ReplyDeleteThank you for the usefu info! Income Tax Return Filing is actually super easy! And it is not as costly as one might think!

ReplyDeleteGreat guide on filing income tax returns! It's always helpful to have a clear step-by-step process, especially for those who are new to it. For businesses in Melbourne looking for expert assistance, LTE Tax is a reliable option for business tax returns in Melbourne.

ReplyDeleteStruggling with income tax filing? A personal accountant ensures accuracy, maximises deductions, and saves you time. At KPG Taxation, we handle everything—so you stay stress-free. Get expert guidance and lodge your tax return with confidence.

ReplyDelete"Fantastic post! Filing your income tax returns on iTax seems much easier when broken down into simple, manageable steps. It's just like managing your online presence—following the right steps leads to the best results. Just as you need to stay organized and precise when filing taxes, using a reliable tool like thefastest SMM panel Getmylikes, ensures you grow your social media efficiently and effectively. Both require a strategic approach for success, whether it's taxes or online visibility. Thanks for sharing this helpful guide—it's a great reminder that the right steps lead to smoother results in both areas!"

ReplyDeleteGreat article! Filing income tax returns can feel overwhelming, but breaking it down into simple steps like you’ve done makes it much easier to understand. The iTax system is indeed a helpful tool for taxpayers looking to file quickly and efficiently. One of the most important things to remember is ensuring all your documents are up-to-date and correct before submitting. For anyone looking to simplify their online presence and improve engagement with their audience, a tool like GetMyLikes Best SMM Panel can help manage social media accounts seamlessly. As businesses grow, having effective management and marketing tools is just as crucial as staying on top of tax filings! Thanks for the useful tips

ReplyDelete