The government plans to build 500,000 houses as part of it's affordable housing project. According to the affordable housing portal (Boma Yangu), this is how it is going to work.

|

| pexels.com |

Kenyans will register and state the kind of house they want and in which county on the affordable housing portal. Right now the registration is to gauge interest and assess needs (what kind of houses people want).

Once you register, you'll get a unique identification number

to use to make monthly contributions to the Housing Fund, managed by the

National Housing Corporation (NHC).

Making contributions

You can make your contribution as:

- Statutory contributor – This is the mandatory contribution deducted by your employer from your salary (1.5%) and submitted to the Housing Fund every month. Contributions are capped at Sh2,500 per employee and employer per month.

- Voluntary contributor – If you choose this option, you can contribute as much or as little as you want. You can withdraw these funds after five years for housing related activities or after 15 years or upon reaching retirement age (65 years). Your contribution will not be taxed at the time of withdrawal. If you choose to make voluntary contributions, you will not be able to access your money at any time. You will be subject to withdrawal rules (after five years for housing-related projects or after 15 years or retirement age).

- Joint contributors – This option allows you to make a contribution towards one house at a time with your husband or wife, but you can each choose to contribute individually. You can also do this jointly with other people towards one house. If you apply jointly, your incomes will be assessed jointly and the title of the house will be issued in the name of all the joint applicants.

Will my contributions

earn interest?

Your contributions will earn a return every year, which will

be announced based on the Housing Fund’s performance.

Allocation of houses

Allocation of houses will start when construction begins. Civil

servants, the police and other members of the disciplined forces will get the

first right to 30 per cent and 20 per cent of all available housing units, with

the rest going to other Kenyans. The allocations will be computerised (done by

an algorithm that sifts through profiles in the portal to prioritise those who

need the affordable house most). If you don’t get allocated a house in the

initial allocation, you will be put on a waiting list and given priority in the

next allocation round. You can only buy one house under the affordable housing

plan.

Factors to be

considered in allocation:

- When you registered (first come, first served)

- Your income

- Family status (families will get preference)

- Vulnerable groups

- How much deposit you’ve accumulated through monthly contributions

- Your assets

- Demand for your preferred type of house

|

| pexels.com |

What kind of house do

I qualify for?

The affordable housing scheme targets people in the

following income groups (low and middle-income or people who earn less than

Sh100,000 per month). The kind of house you qualify for will be based on your

income.

- Social housing – Kenyans who earn up to Sh19,999

- Low-cost housing – Kenyans who earn between Sh20,000 and Sh49,999

- Mortgage gap – Kenyans who earn between Sh50,000 and Sh100,000

Those who earn less

than Sh20,000 per month will be offered three options:

- One-room house at a cost of Sh600,000

- Two-roomed house at a cost of Sh1 million

- Three-roomed house at a cost of Sh1.35 million

Those who earn

between Sh20,000 and Sh150,000 per month, will also get three options:

- One bedroom house (30 square feet) at a cost of Sh1 million

- Two bedroom house (40 square feet) at a cost of Sh2 million

- Three bedroom house (60 square feet) at a cost of Sh3 million

You will be advised on the projected monthly rent-to-own

payments based on the 3% to 7% per annum interest rates.

To ensure that those who qualify for social housing are the

actual beneficiaries of the houses being built for them, the government plans

to verify and register them in their communities. If there is more demand than

supply for social housing, those who need affordable housing more will get

priority.

How will I pay for

the house?

Eligible Kenyans (those who earn less than Sh100,000) can

buy the houses through the National Tenant Purchase Scheme (a rent-to-own model).

What this means is that once you are allocated a house, you will be living in

the house and paying “rent”, but in this case, that money goes towards owning

that house, such that once you have paid for the full cost of the house, it

belongs to you and you can stop paying rent. The mortgage or home loan will be

offered at a fixed interest rate of 3% to 7% per year over a 25-year period.

This means that your “rent” will not change/in the 25 years you take to pay for

the house.

Monthly costs (service

charge)

Apart from the monthly rent-to-own payments, you will also

be required to pay an affordable service charge to a company contracted to

maintain the facilities including the common areas and to fund major repairs of

the housing complex. You will continue to pay the service charge long after you

have finished to pay for the house.

What happens to those

who earn above Sh100,000?

If you don’t fall within the above income groups (you earn

more than Sh100,000), you will contribute to the Housing Fund (remember there

are mandatory contributions for those who are employed, and you can also do

voluntary contributions), but because you are not eligible to be allocated an

affordable housing unit, you will have access to cheaper home loans from banks

and Saccos through funding from the government’s Kenya Mortgage Refinance

Company (KMRC).

You can also get your contributions after five years and use

them for other housing-related activities, such as a deposit (down payment) for

a mortgage, mortgage repayment or to improve your house.

If you don’t claim

your savings for housing-related activities, you can get them back after 15

years or upon attainment of retirement age. So say you earn Sh100,000 a month

and you pay Sh1,500 a month (1.5%) for the Housing Fund, in five years you will

have contributed Sh90,000 and in 15 years you will have contributed Sh270,000 (if

your income doesn’t change).

If you contribute Sh2,500 a month, in five years you will

have contributed Sh150,000, and in 15 years you will have contributed

Sh450,000.

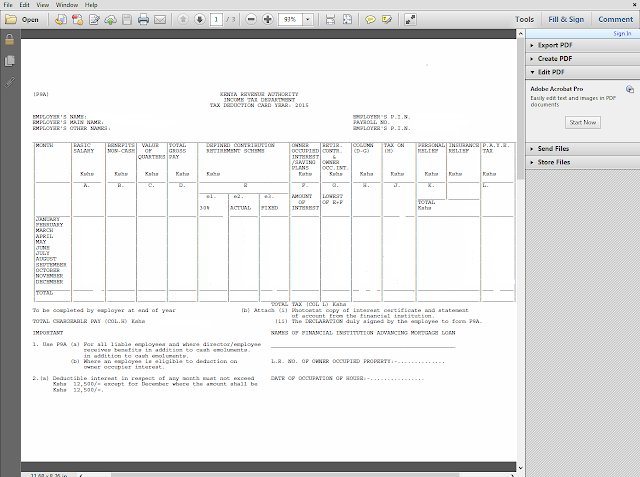

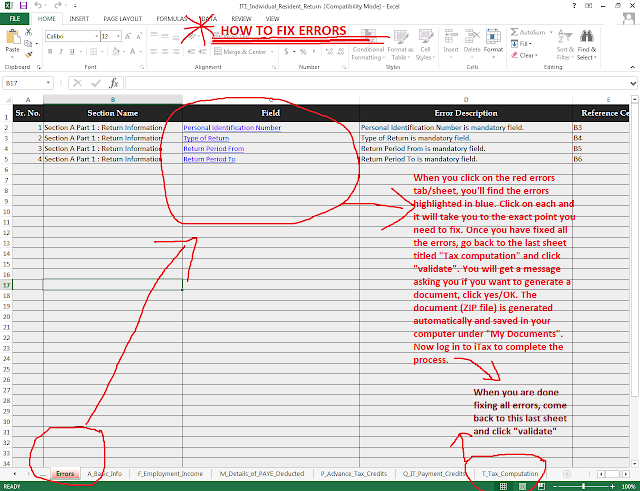

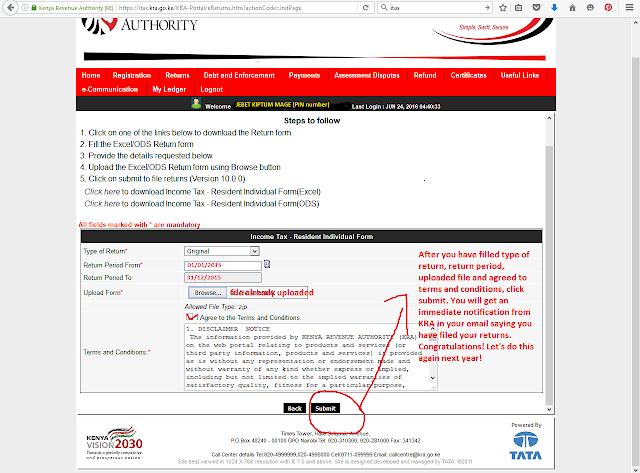

Tax relief

Those registered on the affordable housing portal are

eligible for tax credit/relief equivalent to the amount contributed or the

lower tax payable, up to a maximum of Sh9,000 per month. Self-employed Kenyans

who are registered on the portal will also get tax relief, and both mandatory

and voluntary contributions will get tax relief. For the employed, the

deductions and tax relief will be handled at payroll. For the self-employed,

you will get your tax credit when filing your taxes. First-time home

owners/buyers will not pay stamp duty.

Who is building the

houses?

The houses will be built by private developers, who will

then sell them to the government, which will then offer the houses to Kenyans

registered on the affordable housing portal. The government will provide land

for building the houses, including in the counties, build access roads and the

transport network, and set up infrastructure (electricity and water and sewerage).

The housing portal will help in automated identification of the buyers.

Upcoming projects will be announced on the housing portal,

in the newspapers, on radio and in Huduma Centre.

Rural areas

The government will support homeowners in rural areas to

improve the homes they live in or to build new ones using locally-available quality

building materials such as stabilised soil blocks. Already, 92 Appropriate

Building Technology (ABT) centres have been constructed across the country,

with a plan to have one in every constituency, then one in every ward across

Kenya. Staff at these centres will offer technical assistance and equipment to

members of the public to improve the quality of their houses. There will be

Matofali machines, which are used for the manufacture of stabilised soil blocks,

for hire. TVET colleges will also train members of the public on how to use cost-effective

and environmentally-sustainable building technologies and how to modernise

construction practices while preserving cultural values. Kenyans living in

rural areas can apply for funding from the Housing Fund at 7% interest rate.

|

| pexels.com |

Can I get a house if I don’t have a regular income?

Yes, but you have to prove that you are able to make regular

monthly loan payments.

What if I am unable

to pay the monthly payments?

The payment terms are designed to be affordable and

flexible, geared towards helping you secure your home. However, every case will

be looked at on a case by case basis. The government will engage insurance

companies to develop home insurance products to cover home owners/buyers

against losing their home if they lose their income/job. The cover will pay all

or part of the monthly mortgage payment for a limited time, if a person loses

their job involuntarily or if they lose income due business disruption,

disability, hospitalisation, death.

Can I sell my house?

You will have to wait for eight years before you are allowed

to sell the house. If you want to sell it before eight years have lapsed, you

can only sell it back to the Housing Fund and retain the equity build-up i.e.

the amount of your home you actually own, based on the amount of money you have

already paid for it.

What happens if I

die?

The house can be transferred to your next of kin.

For more information log on to: