There is always an opportunity to save money to help you reach your goals faster. Here are some tricks you can use to help you save a little bit more if you are having difficulties finding money to save or in addition to your regular savings schedule

1. Save automatically before you spend.

When you get your income, before you do anything else, deduct your savings and put them into a savings account. To make it even easier, set up a check-off system from your employer (payroll department) to a money market fund or Sacco savings account or set up a standing order from your current/salary account to a savings account so that money is deducted automatically from your main account and transferred to your savings account before you touch it. Saving automatically is the best way to save without a struggle.

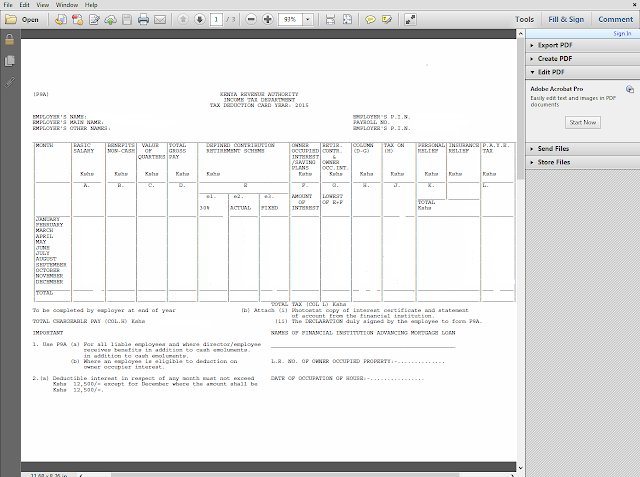

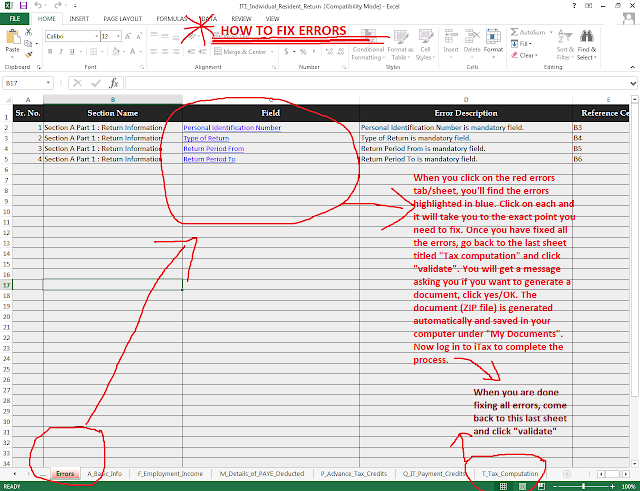

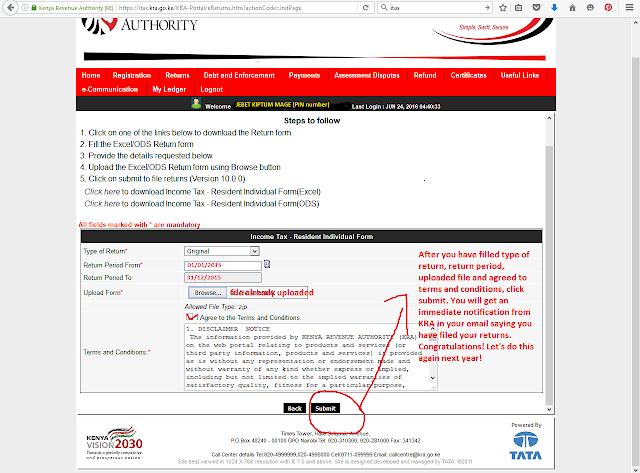

For those who pay income tax (pay as you earn/PAYE), doesn’t the government take off 30% or so before you even touch your salary? And after the government and NHIF, NSSF, insurance, loans and everyone else has taken their cut, they leave the rest to you and you learn how to budget around it. Why not include yourself in the group of people who get their cut first, before you distribute what is left to your landlord, school and all those other people who are waiting for a chunk of your income?

If you say that you will save after you have finished paying the bills, you will never have any money left to save, so prioritise and automate your savings.

2. Save your loose change. At the end of every day, I empty my purse and divide the various coin denominations I find in there into two. For example all 10 bobs are put into two piles, then all 20 bobs and all 5 bobs. The first pile goes back into my purse, and the second pile goes into the piggy bank I use for saving coins. When it fills up, I top up if I need to and transfer it to my money market fund account.

3. Save all 50 bobs or all 100 bobs that pass through your hands. Just like in (2) above, you can decide to save all the Sh50 or Sh100 or any other denomination of your choice that pass through your wallet.

4. When you finish paying off a loan, don't stop. What do I mean? Take that money you've been paying a loan with and set up an automatic standing order to a savings account or set up a check-off system to a money market fund. So say you've been paying Sh5, 500 for a loan every month and you have just finished paying your loan, instead of finding ways to spend that Sh5, 500, start saving it, preferably using an automatic standing order or check-off system. If you save that Sh5, 500 you used to pay your now paid-up loan with for 12 months, you will have Sh66, 000 to help you reach your savings goals faster.

5. Save your salary increment. If you get a raise (salary increment) at work, instead of adjusting your budget/lifestyle upwards to absorb that money, continue living on the same amount you were living on before (as if you are still earning the old salary) and save the extra amount your employer has given you. So say you get a Sh6, 000 raise, you can set up a standing order to save that money automatically and in 12 months, you’d have Sh72, 000 in savings. This is the same principle in number (4) above.

6. The same applies to if you “find” money. Finding money means getting money you were not expecting, such as a refund, a discount, reimbursement of costs by your employer, or even finding a Sh1, 000 note in a trouser pocket you had forgotten long ago. Instead of using that money, put it directly into your savings account without second thought.

7. Save your lunch money. Carry lunch to work a few days a week and save your lunch money. For instance, if you usually buy lunch at work for Sh300, you can decide that on Mondays and Thursdays you will carry lunch from home, so that week, you save Sh600 and put it into your savings account. You could decide to carry lunch three days a week, so that week you'll save Sh900. You could decide to carry lunch the whole week, so that week you'll save Sh1,500 or more.

8. Save your fuel. You could do the same with your car. If public transport is cheaper than using your car, you could decide that three days a week, you'll take a matatu home and save the amount you would have spent on fuel on those three days. You could also decide that that whole week, you'll take a matatu and put the amount of money you would have used on fuel into your savings.

9. Do a spending fast. In religious circles, to fast is to abstain from food/eating for a specified period of time during which one says fervent prayers for a specific purpose. You can apply this principle to personal finance to help you save. This is basically the principle behind point (5) and (6) above and it basically means cutting off everything that you don’t need to survive and saving the money that you would normally use on the non-essentials.

To be able to do a proper spending fast, you have to first know where exactly all your money is going -- every last coin -- so first track your expenses for a month and then evaluate what you actually need (essentials/things that you honestly cannot live without) and things you can actually do without.

Once you see where exactly your money is going, you can cut back on the non-essentials and the money you save by not spending, should go directly to your savings account. This could mean carrying lunch instead of buying lunch every day (if you carry lunch from home for a full month, and you usually spend Sh300 on lunch every day, you’ll be able to save Sh6, 000 or more that month. Put it into your savings account). You can also cut back on coffee and alcohol, you won’t die without them (unless you are addicted). Say you spend Sh3, 000 on alcohol every weekend, if you decide to reduce that amount to Sh1, 000, you will save Sh8, 000 that month. If you decide to do an alcohol-free month, you will save Sh12, 000 that month. You can even decide to do without DSTV for a month, you won’t die from not watching pay TV.

I’m not saying that you shouldn’t have fun; saving is not all gloom and doom; on the contrary, if you learn how to optimise your spending, you will not only have more fun and less stress, but you will also be able to achieve those things you only used to dream about, but thought that you could never afford them.

Secondly, if you do your spending in moderation and do your spending fast for limited periods of time (rather than forever -- that would make you a miserable miser), you will find money to boost your savings. (We’ll talk about having fun while still being able to save in another post.)

10. Carry only the exact amount of money you need. This goes hand-in-hand with the spending fast. So say my fare is usually constant at Sh200 for the trip to work and back and I use Sh200 for lunch, that day I will carry exactly Sh400 in my purse or Sh500. I will make sure that my Mpesa balance is zero (and resist the temptation to opt into Fuliza), that my bank accounts are not linked with mobile money, so I can’t transact from my phone, that I don’t carry ATM cards, etc. This means that even if I am tempted to buy things on impulse, I simply cannot because I don’t have any money on me to spend. (We’ll tackle impulse buying in another post).

11. Round it up. When you buy something and the cost does not end in 0 (zero), save the amount of money it would take to get the cost to end with 0 (zero). For example, if you buy something costing Sh42, put the 8 bob change in a piggy bank or transfer an equivalent amount to your Mshwari Lock account. If you use a piggy bank, when it fills up, you can transfer the full amount to your savings account or money market fund.

12. Lastly, make it difficult to access your savings. A savings account without a debit card (ATM withdrawal card) and with limited withdrawals, is best. I have a Sacco savings account that only allows you to withdraw money at the end of the year.

I have a money market fund account where withdrawing money takes like three days and where the first withdrawal is free, but subsequent withdrawals are charged Sh1,000 per withdrawal.

When I think of paying Sh1,000 to withdraw, I just let my savings be unless I have actually accumulated the exact amount I need to meet a certain goal, then I can withdraw and pay for my goal without feeling the pinch. So do whatever it takes to create a barrier between you and your savings, to make it hard for you to withdraw your savings anyhow and any time. You are saving for a purpose and you cannot achieve your financial goals if at all you can withdraw your savings randomly to buy things on a whim.

I hope these tips help you save more money, and if there are additional tips you use, please share in the comments. Happy saving!

*These tips were first shared in the 52-Week Savings Challenge Kenya in 2016